Call our team today on 0161 388 8875

Pension Consolidation

Too many Pensions to keep track of?

Pension Consolidation could be the answer for you.

Are you finding it difficult to keep track of all your separate pensions? Are you unsure where to start in your quest for a better retirement?

Try our our FREE pension review service worth over £500 complete our form and get clarity on your options today.

Start Your FREE, No Obligation Pension Review Today

A cashback offer you

don’t want to miss!

At Neo we know the importance of having a good financial plan, and we are confident the value of our advice pays.

We make it easy for you to transfer an investment or pension, and we’ll even take care of managing your new plan for you.

That’s why we are offering a cash back incentive when you take our services up – for any new pensions, pension transfers or investments

we will inject £200 cashback into your portfolio to boost you in the right direction.

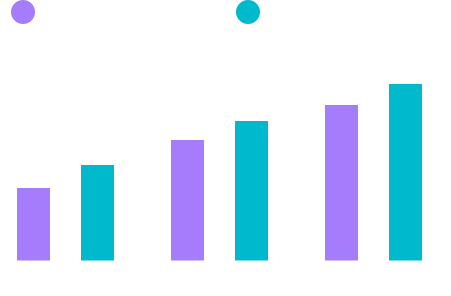

Value of Advice

Advice pays. Here's the evidence.

Studies show that those who take independent financial advice are better off than those who don’t.

NON-ADVISED

£92,921M

Investments

Consumers with advisers save longer and contribute more to investment products, leading to an average of £40,000 more in investment value than those without advisers.

ADVISED

£59,000

NON-ADVISED

£38,918

Savings

Consumers who seek advice on cash-based saving products save an average of £20,000-£59,000 more than those who did not seek advice.

ADVISED

£175,121

NON-ADVISED

£92,616

Pensions

The average pension pot for consumers with financial advisers is nearly twice the size of those without advisers.

The UK average

£21,164

Average pension pot size

33%

Regularly contributing

Greater London

£22,315

Average pension pot size

33%

Regularly contributing

Compare your region to the UK average by clicking on the map

- East Mid Lands

- Northern Ireland

- Greater London

- South East

- North East

- North West

- Scotland

- South West

- Wales

- West Mid Lands

Our Pension Review Service and how it works

The pension review service provides you with a clear picture of the performance of your pension fund, recommends ways you can improve it, and our advisers may suggest putting certain plans in place to leave you better off when you stop working, only if these are in your best interest. If there is no need to make any changes to your current pension pot, we’ll let you know with full transparency.

Our team will

Evaluate whether the amount you’re currently paying in will be enough for a comfortable retirement.

Check and review where your pension is being invested and whether you’re happy with that.

Ensure that the investment profile of your current pension fund is in-line with your preferences in terms of its level of risk.

Assess the fees you’re being charged for fund management and whether they’re fair and reasonable in relation to the pension’s level of risk and the amount paid in.

Find any pensions from previous employment that are ‘frozen’ or ‘preserved’ and recommend what to do with them, i.e., would it be worth putting them into one larger fund?

Why choose us?

Neo Wealth is part of an award-winning network made up of over 20 UK based individuals, advisers, technicians, and administrators. With 11 offices worldwide servicing over 20,000 clients.

We’re Accredited With The Pension Transfer Gold Standard So You Can Have Confidence In Us. Get Trusted And Impartial Advice On Your Pension Options Giving You Peace Of Mind, oh and we are also Chartered! because people are at the heart of what we do.

Call our team today on 0161 388 8875

Guide to SIPPS & Personal Pensions

Introduction

In 2021 there was an estimated £20 billion in deferred ‘frozen’ pensions, they can be a maze for many of us; some don’t have the time, others don’t know where to begin and most don't even know what options are available to them.

We all dream of spending our well-earned retirement doing what we love without worrying about money. But getting your dream retirement can take a lot of effort and discipline to ensure you have enough cash to be comfortable during your golden years. In fact, according to a recent study, you’ll need at least £10,200 a year to have all your basic needs covered in retirement. Assuming you finish work at 67 and live until the age of 82, you could need around £153,000 in your pension pot by the time you retire. This amount can sound scary, but don’t worry, there are many ways to help you reach your retirement goals.

The average pension pot by age

Age has significant impact on the gender pension gap, with inequality increasing as women get older. By the time women reach their 50s, men have a pot that’s almost twice the size.

18%

Gender Gap

£3,215

Average female pot

£3,925

Average male pot

£140,700

Average pension pot size at 65

13%

Have invested in a responsible plan

21%

Gender Gap

£9,537

Average female pot

£12,075

Average male pot

£135,900

Average pension pot size at 65

14%

Have invested in a responsible plan

29%

Gender Gap

£22,589

Average female pot

£33,598

Average male pot

£112,900

Average pension pot size at 65

12%

Have invested in a responsible plan

46%

Gender Gap

£28,249

Average female pot

£52,592

Average male pot

£87,500

Average pension pot size at 65

7%

Have invested in a responsible plan

Pension FAQS

How many workplace pensions have you forgotten about?

According to a study, the average worker will have 6 different jobs throughout their working life

Source: AAT (Association of Accounting Technicians)

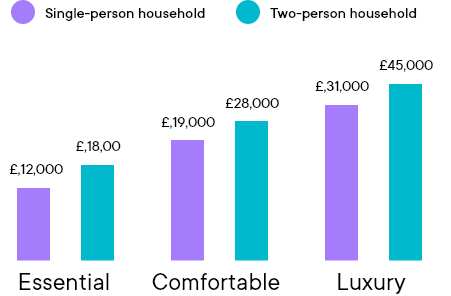

How much cloud you need for your ideal retirement?

Based on the results of a recent Which? survey, here's how much you might want to aim to have each year for various types of retirement..

How much is there in lost pensions?

It's estimated that there is around £19.4 billion sitting in forgotten pension pots, with there being an average of £13,000 in each one.

Source: The Association of British Insurers (ABI)

1 IN 2 People

Do not have enough money for their day-to-day needs. While only 37 percent of the population report having a financial plan.

womEn

Women are the ones who propel financial conversations

Women drive 40 percent of the financial conversation on Facebook, generating around 6.5 million posts, comments, likes and shares each month.

So if you're turned-off and confused with the typical rubbish pensions communications and feeling as though you’ve missed out by not saving much sooner for your future?

Complicated jargon, scary forms and pages and pages full of technical information is not how it should be, that’s why we set out to change things. Pensions, investments, tax, mortgages – let’s face it, these subjects are often made to sound a lot more complicated than they actually are. If you need support with making these subjects more digestible, look no further.

Let's get started

We would love to update you on our offers, handy guides and the latest Neo Financial Planning info.

Have a question? Call us on

0161 388 8875

Monday to Friday 9am – 5pm