Get to Know Your Pension

Your pension is vital…

It can provide an essential money source for your dream retirement and enable you to live the lifestyle you have worked hard to obtain. Pensions have also changed significantly over the last 20 years.

Do you know exactly what’s going on with your pension at any time?

People today increasingly enjoy multiple careers, likely resulting in multiple pensions, with different providers and associated administration. Neo Wealth can help you with everything pension-related, tracking down old schemes, talking about accumulation, drawdown and even pension transfers. We can help you get to grips with how pensions work and manage everything effortlessly for you.

Got old pension pots to combine?

Our team of pension experts can track and transfer your old pensions – even if you don’t know the details.

Our retirement planning specialists offer a number of services bespoke to your needs. These areas can be complex and often need special care and attention.

To speak to one of our friendly experts about how Neo Wealth can make your life easier, email [email protected] or call 0161 388 8875 to make an appointment for a free, no-obligation chat virtually or in person with plenty of coffee and cake.

learn more in our knowledge lab

You can keep on top of relevant industry news by checking out our blog page, where we discuss topical subjects to further help you answer any questions you may have. We also have free wealth calculators, pension calculators and free download guides throughout the website.

To learn more about how we can help you, contact us today:

0161 388 8875

The UK Pension Landscape

See how UK pension pots differ, depending on region, age and gender

The UK average

£21,164

Average pension pot size

33%

Regularly contributing

Greater London

£22,315

Average pension pot size

33%

Regularly contributing

Compare your region to the UK average by clicking on the map

- East Mid Lands

- Northern Ireland

- Greater London

- South East

- North East

- North West

- Scotland

- South West

- Wales

- West Mid Lands

The average pension pot by age

Age has significant impact on the gender pension gap, with inequality increasing as women get older. By the time women reach their 50s, men have a pot that’s almost twice the size.

United Kingdom

North East

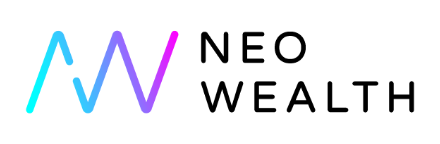

Male £20,514

Female £11,177

North West

Male £18,843

Female £10,988

East Midlands

Male £22,218

Female £12,898

West Midlands

Male £22,141

Female £13,124

South East

Male £32,025

Female £19,046

South West

Male £24,641

Female £13,326

Greater London

Male £24,853

Female £17,863

Scotland

Male £22,266

Female £12,247

Northern Ireland

Male £17,883

Female £7,737

Wales

Male £20,053

Female £11,426

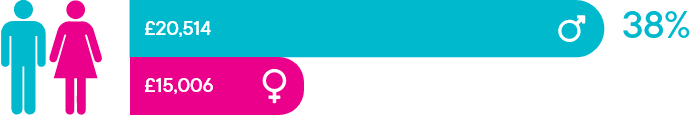

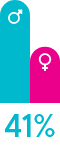

The average pension pot by age

Age has significant impact on the gender pension gap, with inequality increasing as women get older. By the time women reach their 50s, men have a pot that’s almost twice the size.

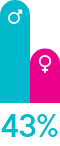

18%

Gender Gap

£3,215

Average female pot

£3,925

Average male pot

£140,700

Average pension pot size at 65

13%

Have invested in a responsible plan

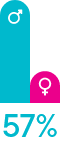

21%

Gender Gap

£9,537

Average female pot

£12,075

Average male pot

£135,900

Average pension pot size at 65

14%

Have invested in a responsible plan

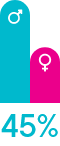

29%

Gender Gap

£22,589

Average female pot

£33,598

Average male pot

£112,900

Average pension pot size at 65

12%

Have invested in a responsible plan

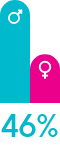

46%

Gender Gap

£28,249

Average female pot

£52,592

Average male pot

£87,500

Average pension pot size at 65

7%

Have invested in a responsible plan

How socially responsible are British pension savers?

Finally, we looked at how many Brits invest in a socially responsible plan.

The UK average

13%

Let's get started

We would love to update you on our offers, handy guides and the latest Neo Wealth info.

Have a question? Call us on

0161 388 8875

Monday to Friday 9am – 5pm